does san francisco have a payroll tax

Does San Francisco Have A Payroll Tax. Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments.

2022 Federal State Payroll Tax Rates For Employers

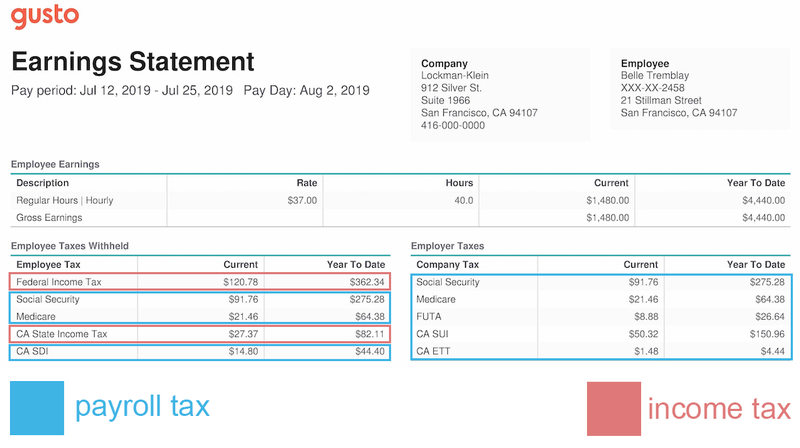

Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare 145 each plus an additional 09 withheld from the wages of an individual paid.

. We offer Payroll forms. Until 2018 all businesses with a taxable san francisco payroll expense greater than 150000 must file a payroll expense tax statement for their business annually by the last day of february for the prior calendar year jan. The tax is calculated as a percentage of total payroll.

Although the Payroll Expense Tax was originally scheduled to fully phase out in 2018. There is sales tax a state tax some of which goes to the county. Over the years the payroll tax rate has changed from a low of 11 percent to a high of 16 percent.

Exemption provisions are listed in Section 954The most common exemption is for certain non-profit organizations. Lean more on how to submit these installments online to comply with the Citys business and tax regulation. Proposition f is intended to complete the citys transition from a.

The payroll tax became effective on October 1 1970. Allen County levies an income tax at 148 Clinton County at 245 Fountain County at 21 LaGrange County at 165 Marion County at 202 and Sullivan County at 17 as of January 2021. The tax is calculated as a percentage of total payroll expense based on the tax.

San Franciscos payroll expense tax was set to fully phase out in 2018 after the phase-in of the Citys gross receipts tax. Administrative Office Tax For any business maintaining an administrative office in the city the tax is graded based on companies CEO pay ratio 04 of companies total taxable payroll expense attributable to San Francisco for ratios above 1001 up. The City of San Francisco City has issued the payroll expense tax rate for 2019 which is unchanged from the prior year at 0380.

City and County of San Francisco. They ask that you obtain an EIN withhold taxes verify your workers eligibility before hiring and register them with the state after they begin working for you. Thu 07242014 - 1310.

The following are exempt from payroll tax. It is important for San Francisco decision-makers to understand the complexities of these issues before making enacting major changes to the business tax. Morenovel Shutterstock In an attempt to help alleviate the housing affordability crisis in San Francisco city officials have proposed a.

Payroll Expense Tax. Since 1995 the payroll tax rate has been 15 percent. The tax rate reaches its maximum level when the ratio reaches 600 to 1 with a maximum tax on payroll of 24 percent or a surcharge on the gross receipts tax of up to 6 percent.

If you have questions regarding any San Francisco tax matters please contact either of the following Deloitte professionals. Tax is best although payroll taxthe type of business tax currently levied by San Franciscois uncommon and may have strong negative effects on wage and employment levels. Companies in san francisco with a ceo pay ratio of 1001 or more will be subject to the measure l tax and the tax rate will increase for every additional 100 times the ceos pay exceeds the.

This article is part of a larger series on How to Do Payroll. And of course the fine you get when you forget to move your. Persons other than lessors of residential real estate are required to file a return if in the tax year you were engaged in business in San Francisco were not otherwise exempt and you h ad more than 2000000in combined taxable San Francisco gross receipts.

Residents of San Francisco pay a flat city income tax of 150 on earned income in addition to the California income tax and the Federal income tax. Payroll Expense Tax PY Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021. Starting in 2014 the Payroll Expense Tax was to be phased out over a five-year period and replaced with the Gross Receipts Tax which has been gradually phased in from 2014 to.

The 2018 Payroll Expense Tax rate is 0380 percent. Please refer to the table below for a list of 2021 Payroll Taxes employee portion and employer portion that are applicable to the city of San Francisco in the state of California. PAYROLL EXPENSE TAX ORDINANCE Sec.

Erica Augustine manager Deloitte Tax LLP San. This ordinance shall be known as the Payroll Expense Tax Ordinance and the tax imposed herein shall be known as the Payroll Expense Tax Ord. Nonresidents who work in San Francisco also pay a local income tax of 150 the same as the local income tax paid by residents.

There is a hotel tax paid by visitors. All 92 counties in Indiana have an individual income tax ranging from 15 in Vermillion County to 285 in Pulaski County. The city of san francisco city has issued the payroll expense tax rate for 2019 which is unchanged from the prior year at 0380.

Hal Kessler managing director Deloitte Tax LLP San Francisco 1 415 783 6368. Does san francisco have a payroll tax. Youll find whether your state has an income tax and any local taxes.

San Francisco 2021 Payroll Tax - 2021 California State Payroll Taxes. The following requirements are in place for reporting and tax purposes. Tax rate for nonresidents who work in San Francisco.

Answer 1 of 4. For most employers employee and payroll tax is a major. Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the last day of February for the prior calendar year Jan.

54 Fun Things to Do in San Francisco Cool and Unusual. Details Background Before 2014 San Francisco imposed a 15 percent payroll tax on businesses operating in the city. Both employers and employees are responsible for payroll taxes.

Proposition F fully repeals the Payroll Expense Tax and increases the Gross Receipts Tax rates across most industries while providing relief to certain industries and small businesses. San Francisco Business and Tax Regulations Code ARTICLE 12-A. The tax is calculated as a percentage of total payroll expense based on the tax.

Published January 21 2022. There is property tax and it is paid by anyone who owns property in San Francisco. Nevertheless the City ordinance enacting the gross receipts tax allows the San Francisco.

There is no city income tax.

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

What Is Payroll The Complete Guide To Small Business Payroll Wave Blog

How Much Proposition E Will Save Sf Startups Funwithmath Techcrunch

Payroll And Tax Compliance For Employers Aps Payroll

Gross Receipts Tax And Payroll Expense Tax Sfgov

Twitter Posts 55k Of Promoted Tweets To Help Avoid Payroll Taxes Pcmag

2022 Federal State Payroll Tax Rates For Employers

What Is Payroll The Complete Guide To Small Business Payroll Wave Blog

Payroll Tax Specialist Salary Comparably

San Francisco S New Local Tax Effective In 2022

Working From Home Can Save On Gross Receipts Taxes Grt Topia

What Is Payroll The Complete Guide To Small Business Payroll Wave Blog

Payroll And Tax Compliance For Employers Aps Payroll

Due Dates For San Francisco Gross Receipts Tax

San Francisco Taxes Filings Due February 28 2022 Pwc

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Can I Set Up A Payment Plan For Unpaid Payroll Taxes

Social Security Taxes 2022 Are Payroll Taxes Changing In 2022 Marca